This is why Android Pay is asking you for a 'Google Payments PIN' when making purchases

When Android Pay finally arrived to replace the withering-on-the-vine Google Wallet, everyone rushed to get their cards into the app. Those who had a "supported" card from a bank that was in partnership with Google for the launch had a solid experience — tap your phone, and you paid. Anyone who added an unsupported card faced a new hurdle, having to both use a secure lock screen and enter a "Google Payments PIN" code at the time of payment. One extra tap and interaction with the screen, making Android Pay surprisingly less useful.

That's confusing, and Google's (lack of) explanation on the topic isn't helping the situation. We're going to explain what's going on here, why you're being asked to use a PIN code for payments and ultimately what you can do to avoid that.

The Google Payments PIN

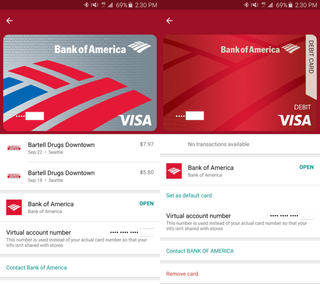

Android Pay is technically only supposed to allow use of "supported" cards from a select handful of banks, and that's done for good reason. When working in partnership with banks and card issuers Android Pay can be more secure, letting your phone talk directly to the bank for transactions, and more useful, with data for things like reward points and detailed transaction histories. And when you have a card from one of these supported banks (check the latest list from Google here) in Android Pay, it's amazingly seamless to make payments. Just unlock your phone, tap the terminal and you just paid.

Confusingly, though, Android Pay actually lets you add unsupported cards to the app as well.

This is a hold over from the old days of Google Wallet, which had an entirely different system that worked without the cooperation of the banks. With Google Wallet, every time you made a transaction it actually made that purchase with a virtual prepaid debit card from "Bancorp Bank" and then that same amount was subsequently charged to your own bank. It was clunky, less secure and downright confusing to everyone involved — and the most annoying user-facing part of this system is the need for an extra PIN code to make a payment.

As Google Wallet hands the reigns over to Android Pay in this transition of mobile payments, this legacy system of using an unsupported card is actually still baked into Android Pay — though Google isn't exactly promoting it as such. This is partially due to the fact that you can bring previously-used debit and credit cards from Google Wallet into Android Pay, and partially because Android Pay just doesn't support that many banks yet — just 10 at the time of writing.

Be an expert in 5 minutes

Get the latest news from Android Central, your trusted companion in the world of Android

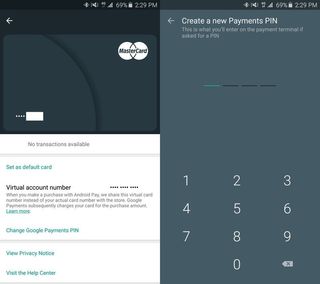

Whether the ability to add an unsupported card should be there or not, it still is and it leads to a rough experience. When you use an unsupported card in this way with Android Pay, it necessitates having a "Google Payments PIN" number as part of the transaction — unlock your phone, tap the terminal, enter a PIN, tap the terminal again. That's not a great experience, and it gives a terrible view of Android Pay to those who only have unsupported cards in the app.

How to avoid needing a separate Payments PIN

This is pretty simple, actually. If you want the absolute best Android Pay experience, which includes not having to enter a PIN, you just have to use a supported card and bank in Android Pay. Google lists all of its supported partners, but you can always tell whether your card is supported by opening up the Android Pay app, tapping the card in question to see its details and looking for the "Change Google Payments PIN" option. If the option is there, the card isn't fully supported. No option? You're good to go.

Most importantly for this whole situation, Google is only allowing you to add unsupported cards to Android Pay for a limited time. Google's own support pages explain it simply — "For a limited time, you'll be able to use some cards with Android Pay that your bank doesn't yet support in the app." We don't know how long that'll be, but we have to say it'd be best to rip this band-aid off early and get it over with. Using Android Pay with a supported card is a great experience, and everyone should experience it that way.

If you don't have a supported card right now (or more importantly, when Google flips the switch to turn off unsupported cards), the best thing you can do is encourage your bank to add Android Pay support. Google seems to be aggressively working with banks of all sizes to get support rolled out, but it's a slow process — and if banks see a swell of customers wanting Android Pay support it can help grease the wheels.

In the meantime, you can choose to use your unsupported card with the additional PIN, or hold out for full support. Either way, at least you know where to place the blame when you have to make a few extra motions to make an NFC payment with Android Pay.

Andrew was an Executive Editor, U.S. at Android Central between 2012 and 2020.